CapitalTime

Articles on investing and capital management, with a quantitative focus.

Five Years of PRP

2021-03-23

I started using this asset allocation on 2016-03-22, and today I am marking the 5 year anniversary. Originally, I was using the Permanent Portfolio, which is almost identical to PRP.

As you might have guessed from sections of my web site such as #growth, I use some non-index strategies. But I am primarily a passive index investor, and I ensure that my total portfolio tracks my “model portfolio” (index benchmarks) closely.

The performance of my model portfolio over 5 years has been 6.7% annualized. This is the same as the long-term historical performance.

I’m very happy with this performance! The portfolio seems to be working as intended.

Some parts up, other parts down

The whole idea of PRP is multi-asset diversification. As I described in Risk Parity - Basics, different parts of the portfolio will do well at different times. There may be long stretches where one particular asset does well, and another does poorly.

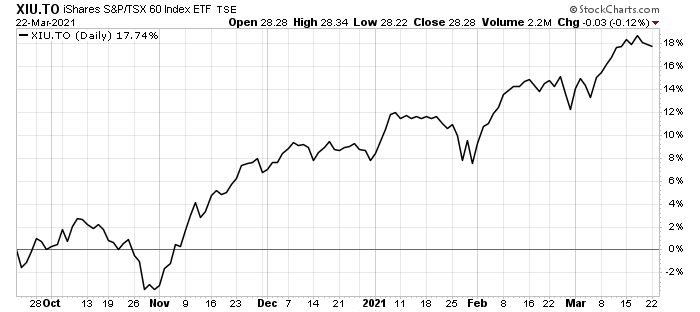

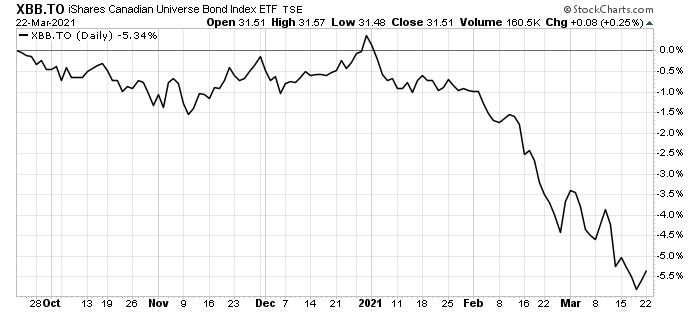

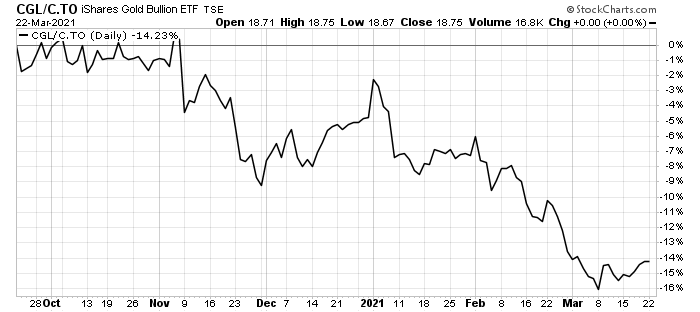

We are seeing this in action, right now. In the last six months (as pictured below) stocks are up strongly, while bonds and gold are down. This may sound unfortunate, but it’s actually a good thing; we want to see this uncorrelated asset behaviour.

Because it’s impossible to predict things like inflation, interest rates, or economic health, the PRP (like the Permanent Portfolio and All Weather) holds all the assets without attempting to predict the future. We hope that one of the assets responds well to the current conditions of the day.

Stocks

Bonds

Gold

— Jem Berkes